My Investment Journey

I started investing after reading “Tony Robbins – Unshakeable” (I recommend his Money Master the game also) it gave me the confidence to start investing with low risk and a dollar-cost strategy.

I started off buying into various Vanguard ETF’s and index funds with low costs. Warren Buffet recommended these funds to his family when he dies.

Then I started following around 3-5 Youtubers that are experts in the stocks and shares field, offering full analysis, ideas and courses to learn ourselves.

I signed up to a few courses and joined a few screeners sites

Unclestock and various other sites like yahoo finance, Investopedia, market watch and finviz.

After watching many Youtubers I started seeing bigger upsides with owning individual stocks and I started growth investing, mostly in big names such as the FAANG stocks.

Then I realised that I needed some cash flow soon due to my age which is 37 at the time of writing this, so I started buying value stocks with good dividends stocks.

I have a really good balance of ETF’s, growth stocks and dividend stocks. I have REIT’s and stocks in different sectors, but I always prefer tech stocks and branded companies.

I came across the FIRE movement, which is “financially free retire early” there are many communities online (FIRE reddit + FI reddit) and many FIRE YouTubers that constantly talk about low cost, low-risk ETFs such as vanguards index funds. Most of these guys talk about frugal living constantly, (some sharing their house, living on a boat, selling their cars for a bicycle) aiming to save 20-70% of their income in the aim of retiring super young, they often aim to have around 24x their annual income in assets such as stocks and they calculate a withdrawal of 2-4% to make sure that they never need to work again, even during recessions. I am not a fan of cheap living, so I work harder to achieve my goal of financial abundance.

Locking in Profits

I am surrounded by entrepreneurs that get rich and lose it all, they have no idea about locking in profits and becoming financially free by planning ahead, investing in the right companies or ETF’s. For example, some people just invest in the S&P500, so you are investing in the top 500 companies in America, therefore you are betting on the American economy, opposed to risking it on individual companies. Shares are there for the average person to preserve wealth, because companies take on inflation, and the shares should beat inflation. But with the right research, knowledge and going against the crowd, there is some good money to make long term. I am not talking about my trading strategy which is completely different and in a different account, all of these are long term positions, providing management don’t make silly decisions or other problems arise, they should be positions to be in forever.

I am aiming for financial freedom with abundance, then I can travel the world in luxury and help charitable events or people in needs.

READ MY 7 STEPS TO HELP ANYONE FROM FINANCIAL DISASTER TO FINANCIAL FREEDOM

Here is my favourite tool to see when you can retire – Compound Interest Calculator

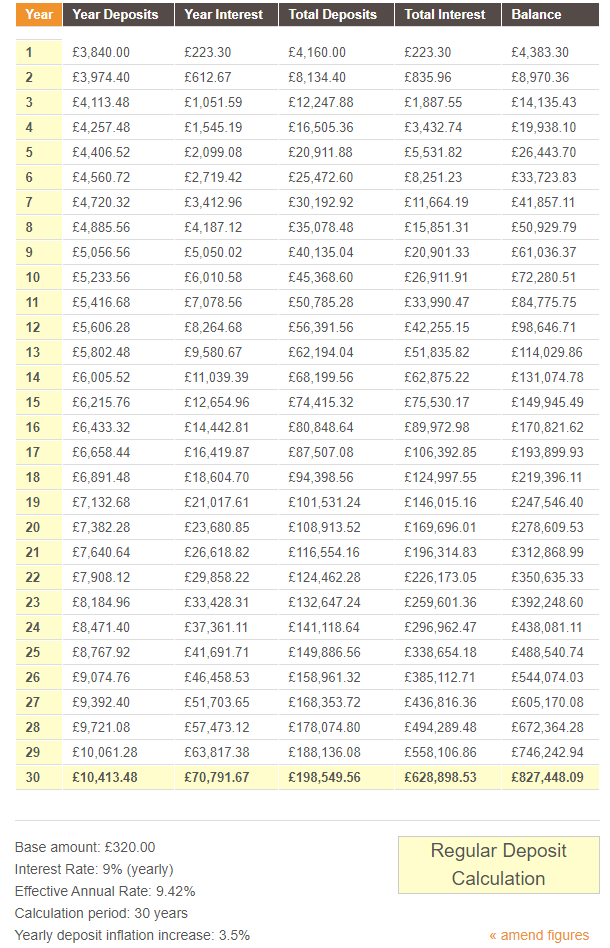

Here is my investing strategy for my newborn son, I have chosen some funds that are doing up to 16% per year with compounding. But let’s say he gets 9% interest per year.

I am putting in 320 GBP a month into various ETF’s and stocks for him

When he is 18 years old he is getting 18,000 GBP a year in interest already that he will be instructed to keep reinvesting when he is 30 years old, he will get 70,000 GBP per year interest, assuming he reinvests and doesn’t put any money in himself. (which he will be doing)

As you can see, its time in the market, not timing the market that is easiest!

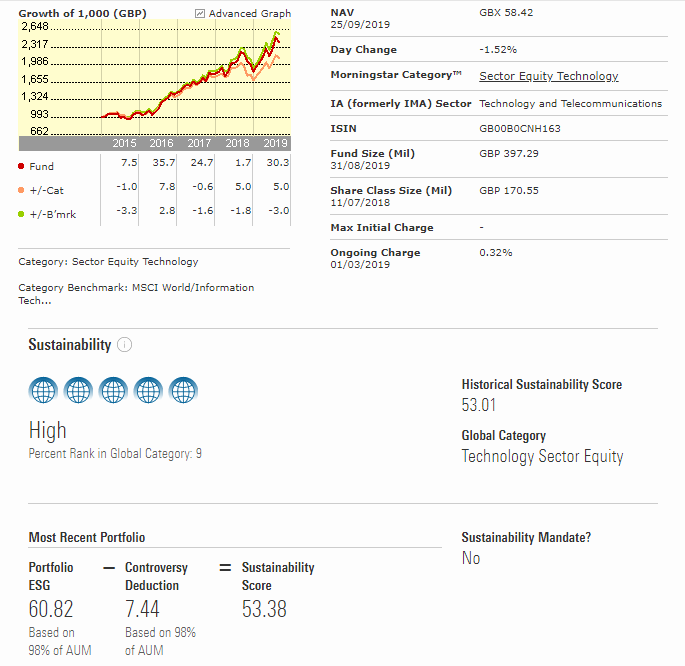

Here is one of the funds I have chosen for him Legal & General Global Technology Index Trust I Class Accumulation and individual stocks like Disney.

This means that my children are set for life and they have the freedom to pursue whatever job that makes them happy, they can afford to choose what makes them happy, such as pursuing charity drives, volunteering or arty stuff. They will be taught that this money needs to be preserved and respected, they will need to work and contribute to society.

This means that my children are set for life and they have the freedom to pursue whatever job that makes them happy, they can afford to choose what makes them happy, such as pursuing charity drives, volunteering or arty stuff. They will be taught that this money needs to be preserved and respected, they will need to work and contribute to society.

I won’t discuss my portfolio figures online right now, but I will say that when I am at around 43-45 years old, I will be more than financially free with abundance, my issue is high family expenses due to having nice cars, house and private school for both children, so it will take a few more years to get to where I want to be, but I could retire right now if I was happy to live cheaply, downgrade the house, cars and schools. (which I don’t want to do or need to do)

I am never going to retire because for me happiness is adding value, my time is already free due to being a CEO of a medium-sized company, so I am already pursuing my dreams of writing, investing and trading. (but it’s not fair to move cities while I am still heavily involved)